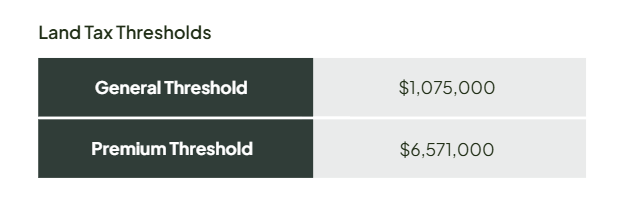

November 2025 – Market Update

Preparing for the 2026 Land Tax Year

From 19 January 2026, Revenue NSW will begin issuing land tax assessment notices. Discover what’s changing in 2026, how to manage payments, and other important details.

1. Key Changes to Land Tax

Principal Place of Residence (PPR) Exemption

From the 2026 tax year, the PPR exemption will only apply if the occupants collectively own 25% or more of the property.

2. Land Tax Clearance for the Purpose of Sale

Early Issue Assessment Notice

Revenue NSW will issue 2026 land tax assessment notices from Monday, 19 January 2026. If your property settlement is early January, you can request your assessment notice in advance.

Land Tax Clearance Certificates

From Monday, 15 December 2025, you can request a 2026 Section 47 land tax clearance certificate through a client service provider (CSP). Submit your application at least 14 days before settlement; processing can take up to 10 business days.